In finance and governance, determining who truly controls a company is important for risk management. This person is known as the Ultimate Beneficial Owner (UBO). However, identifying the UBO has become challenging in modern AML/CFT (Anti-Money Laundering/Counter-Financing of Terrorism) and due diligence procedures.

Regulators, globally and in jurisdictions like Singapore, may demand clear proof of the ultimate beneficial owner to prevent illicit finance, fraud, and corruption. This is where Handshakes’ proprietary mapping technology can help simplify the complex, cross-border tracing required to unmask the UBO, thereby meeting stringent regulatory requirements for financial institutions and government agencies.

The Regulatory Imperative and the UBO Challenge

Understanding what is beneficial owner is paramount because identifying the individual behind the corporate veil is the primary defence against financial crime. UBO identification is essential not just for compliance but for preventing money laundering, terrorism financing, and corruption.

However, the entities engaged in illicit activities have developed methods to hide the ultimate beneficial owner. These techniques include:

- Multi-jurisdictional entities: Creating layers of holding companies across various international registries.

- Nominee directors and shareholders: Using professional agents or ‘straw men’ who appear in public filings but hold no true control.

- Complex trust structures: Utilising opaque legal arrangements to separate legal ownership from actual control.

These deceptions create significant pain points. Tracing the ultimate beneficial owner across different legal systems and non-standardised international registries is a resource-intensive, manual process that often leads to incomplete or inaccurate results, exposing financial institutions to severe regulatory penalties.

Analysts may spend weeks sifting through fragmented paper trails, requesting certifications from multiple jurisdictions, and attempting to reconcile conflicting information. This effort is not only costly, often requiring expensive external consultants, but the final result is often a static, complex document that is difficult to audit or update.

This resource drain, combined with the inherent risk of human error, ultimately leaves organisations exposed, proving why identifying the ultimate beneficial owner requires a decisive technological solution.

Mapping Technology: The UBO Tracing Engine

Handshakes offers the definitive solution to tracing these pain points by placing technology at the heart of the investigative process. Its core mapping capability, accessed via the Handshakes APP, serves as the dedicated UBO tracing engine.

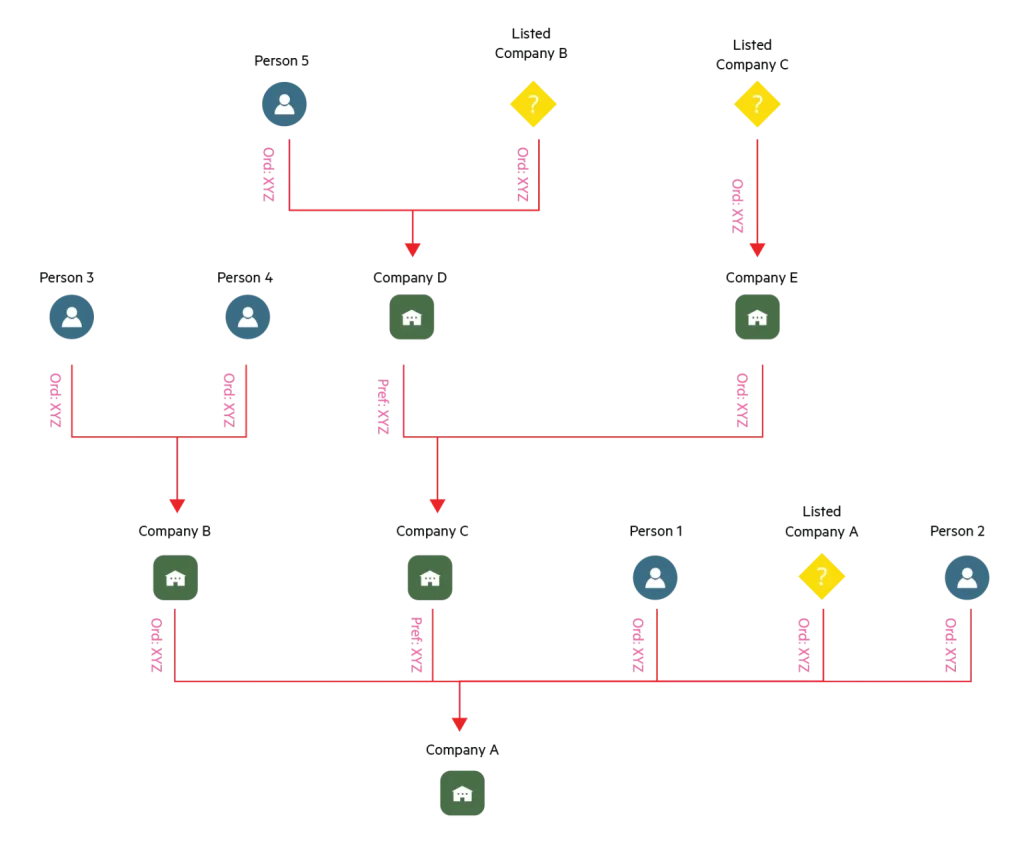

This technology instantly translates complex, multi-layered data—which would otherwise sit in disparate spreadsheets—into an intuitive, visual map, eliminating the need for manual, spreadsheet-based tracing. This visual representation ensures instant comprehension of the ownership hierarchy, even when tracing ownership through multiple layers of entities. The clarity provided reduces the time required for an analyst to move from initial search to validated ownership structure.

Specifically showcased is the Legal Beneficial Ownership (LBO) Map, which details how its intelligent algorithm identifies all natural persons and companies with direct or indirect interest in a subject, aligning perfectly with stringent AML/CFT and due diligence software requirements. This adherence to global standards is non-negotiable for regulated entities.

Handshakes’ breadth of data coverage is continually updated across jurisdictions such as Singapore, Malaysia, Thailand, Vietnam, and China. This multi-jurisdictional data foundation provides the scope required to trace the ultimate beneficial owner for effective cross-border due diligence, ensuring no key intermediary entity is missed.

Practical Applications of Mapping Tech for Clarity

Leveraging mapping technology to achieve clarity provides immediate operational benefits for financial institutions and corporations conducting corporate background checks. Identifying the true owner is crucial, not just for passing regulatory due diligence, but for making informed strategic decisions about counterparty viability, operational risk, and ethical sourcing.

The practical applications span compliance, risk, and operational integrity:

1. Accelerated KYC Onboarding

Instant UBO verification significantly speeds up customer onboarding processes, eliminating delays caused by manual documentation review while maintaining absolute regulatory rigour. This speed is crucial for preventing client attrition and managing backlog, ensuring compliance doesn’t hinder business growth.

2. Enhanced Due Diligence (EDD)

Mapping the full ownership structure is non-negotiable for high-risk clients or complex transactions. This detailed view forms the basis of comprehensive due diligence and justifies risk scores far more effectively than basic registry checks.

Besides, the visual map itself provides a far superior audit trail than a stack of paper documents. Compliance officers can use the map to demonstrate their reasoning in real-time to regulators, providing undeniable proof of the depth of their investigation. This improved auditability is critical in an age of increased regulatory scrutiny.

3. Sanctions and Watchlist Screening

Accurately identifying the ultimate beneficial owner allows financial institutions to screen the actual controller (the UBO) against global sanctions and watchlists (such as OFAC or UN lists). Screening only the legal entity name is often insufficient and can lead to severe fines; robust UBO screening prevents prohibited transactions and avoids prohibitive penalties.

4. Conflict of Interest Mitigation

For large corporates, knowing the ultimate beneficial owner of a supplier helps mitigate potential conflicts of interest in Singapore by ensuring that no internal personnel benefit from external contracts. This proactive background check shields the company’s procurement process from ethical and legal compromise.

Securing Integrity Through Transparency

The severity of non-compliance practices—which often results in millions in fines and irrevocable reputational damage—makes robust tracing a core necessity for corporate integrity.

Handshakes provides the technology that turns the complex regulatory mandate of UBO tracing into an efficient, visual, and defensible process. By leveraging the mapping expertise provided by Handshakes, you can move past simply collecting documents and achieve true AML/CFT compliance through genuine transparency.

Contact Handshakes, a data analytics company in Singapore, to ensure comprehensive AML/CFT compliance and secure the integrity of your business operations.