ON THIS PAGE

Common challenges

Data Cleanup Takes Too Long

The information provided by your clients or merchants are often unverified or may be erroneous. The verification process may also be tedious if done manually.

Getting Your Onboarding Safe & Efficient is Hard

Ensuring a quick and smooth KYC onboarding experience for your clients and merchants is as important as putting robust controls in place. But achieving both simultaneously can seem impossible unless supported by the right software vendor.

No Real-Time Monitoring

Monitoring your clients or merchants in real-time is key to risk mitigation, and at times, required by regulatory bodies. But your KYC platform system isn’t connected to external live data sources that enable you to do so.

Key features of KYC software

Although sourcing high-quality KYC information is challenging, it has become essential for financial institutions and banks for enhanced risk mitigation. This makes it crucial to have software that fully supports you in the following ways:

Supercharge Your KYC Process with Us

1

Access High-Quality KYC Data for Accurate Profiling

As data experts, Handshakes helps our clients unlock your data’s potential. Our KYC software draws from official corporate registry sources and capital markets data in Singapore, Malaysia, Vietnam, China, and Thailand to assist with your KYC and Due Diligence process.

2

Risk Classification & Sanctions Screening

Our KYC software automates the screening of entities and individuals against global sanctions lists, PEP databases, and adverse media sources for a thorough, multi-faceted assessment. This helps flag negative or suspicious mentions at every level, uncovering reputational risks that might not appear on official lists or datasets.

3

Seamless KYC Data Management & Monitoring

Set up a business rules engine and risk scorecard that will allow new accounts to be set up easily & instantly. Our comprehensive KYC software integrates data management and monitoring features for easy regulatory compliance.

4

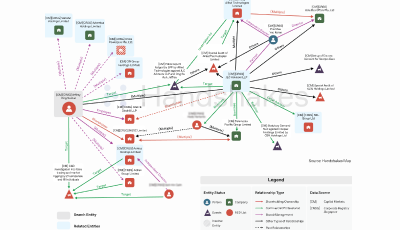

Powerful Risk Analysis with Proprietary Data Insights

Supercharge your risk analysis with proprietary analytics tools that transform complex shareholding structures into instant, actionable insights. Empower your team to make informed decisions and mitigate potential risks with confidence.

5

User-Friendly KYC Data Service Provider for Effortless Compliance

Our intuitive KYC software simplifies complex data interactions, enabling your team to quickly adapt and efficiently manage KYC processes. Keep even the most intricate of compliance tasks straightforward and easy to navigate, allowing your team’s focus to remain on strategic oversight rather than manual data navigation.

Connect to Trusted KYC Data Sources with Handshakes KYC Solutions

Our KYC Solution is Suitable for

- Banking and Finance

- Legal

- Real Estate

- Legal & Professional Service

- Insurance

- Manufacturing and Trade

Leverage our software and services for your KYC

As data experts, Handshakes can help our clients unlock their data’s potential.

Frequently asked questions

Handshakes distinguishes ourselves from the rest through our proprietary mapping analytics, real-time access to official corporate registry data across multiple Asian markets, and the ability to customise solutions to meet unique client needs. This is what makes us a highly effective and reliable KYC service provider.

Our KYC software primarily verifies information found in official corporate registry documents, capital market filings, and related regulatory records. This helps to ensure the accuracy of company structures, ownership, and key personnel.

As a KYC software vendor, our core focus is on corporate data and entity connections. However, our software can seamlessly integrate with third-party eIDV solutions to provide additional layers of personal identity document verification for your clients.

Our KYC software for banks enables rapid, accurate client onboarding, real-time risk monitoring, and efficient compliance with stringent regulations. As a business intelligence agency, our priority is to provide comprehensive data insights into corporate entities and their networks that are crucial for mitigating financial crime risks.

We hope you have found the FAQ useful. If your questions are not addressed here, please do not hesitate to reach us at enquiries@handshakes.com.sg and our consultants will be glad to assist you further.

Our clients

To see if our solutions are the right fit

Request for a demo or speak with us to tailor the right solution for your organisation.